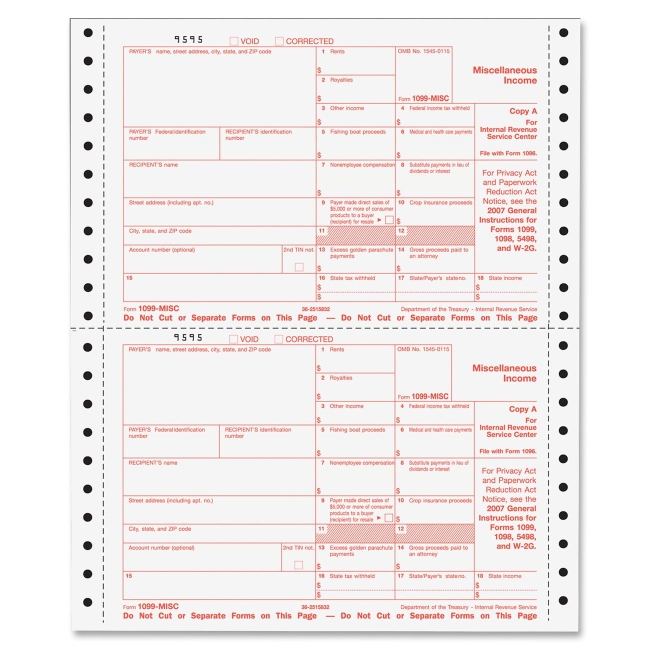

four part continuous 1099 misc form is used to report rents royalties

four part continuous 1099 misc form is used to report rents royalties

w2s 1099 misc forms and

w2s 1099 misc forms and

1099 misc amendment change

1099 misc amendment change

w2s 1099 misc forms and

w2s 1099 misc forms and

1099 misc filled out

1099 misc filled out

w2s 1099 misc forms and

w2s 1099 misc forms and

reporting 1099 misc income is

introducing form 1099 misc

introducing form 1099 misc

![]() what is a 1099 misc irs

what is a 1099 misc irs

tax alert form 1099 misc

tax alert form 1099 misc

reporting requirements for forms 1098 1099 5498 and w 2g

reporting requirements for forms 1098 1099 5498 and w 2g

941 w2s 1099 misc

941 w2s 1099 misc

includes 1099 misc 1099 int

includes 1099 misc 1099 int

1099 reporting provision

1099 reporting provision

w2s 1099 misc forms and

w2s 1099 misc forms and

this five part continuous 1099 misc form is used to report rents royalties

this five part continuous 1099 misc form is used to report rents royalties

w2s 1099 misc forms and

w2s 1099 misc forms and

1099 reporting price 5 95

1099 reporting price 5 95

form 1099 misc should be provided to the taxpayer by the payer of any

form 1099 misc should be provided to the taxpayer by the payer of any

w2 mate w2 1099 software

w2 mate w2 1099 software

for whom reporting to the