businesses large and small

businesses large and small

the new 1099 k aims

the new 1099 k aims

beginning 1n 2012 every

beginning 1n 2012 every

small business owners must

small business owners must

historically the revenues that small businesses receive through credit card

historically the revenues that small businesses receive through credit card

all business payments or

all business payments or

scheduled to begin in 2012

scheduled to begin in 2012

beginning in 2012 all

beginning in 2012 all

![]() what is a 1099 misc irs

what is a 1099 misc irs

1099 law into effect january 1

1099 law into effect january 1

the small business tax relief

the small business tax relief

filed under small business

filed under small business

small business experts

small business experts

the new obamacare 1099 rule

the new obamacare 1099 rule

businesses need to start

businesses need to start

your business during 2012

your business during 2012

the new rules will be quite burdensome for small businesses

the new rules will be quite burdensome for small businesses

small businesses and

small businesses and

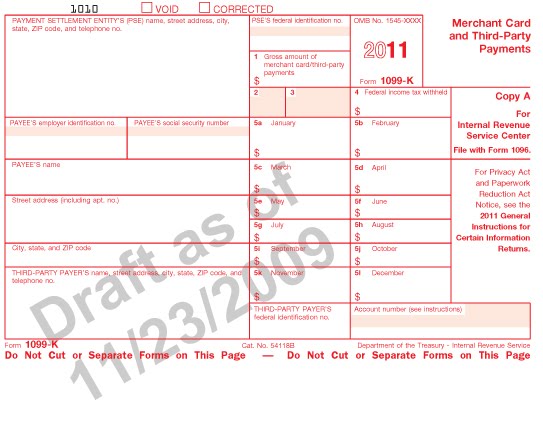

1099 k

1099 k

however the effectiveness of 1099 k in succeeding the closing of tax gap is

however the effectiveness of 1099 k in succeeding the closing of tax gap is